By – Vansh Aggarwal

Abstract:

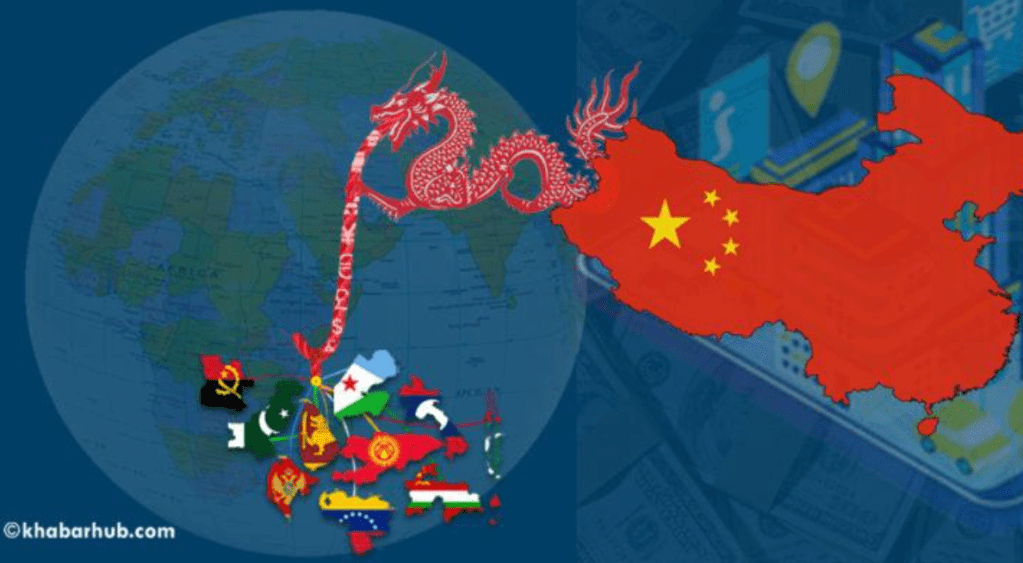

This article examines how China’s Belt and Road Initiative (BRI), framed as development financing, has evolved into a mechanism of debt-driven dependency and geopolitical leverage. Through cases from Asia and Africa, it explores whether BRI represents genuine growth or a neo-colonial chain of credit that undermines sovereignty.

Introduction:

‘The borrower is servant to the lender’ captures the uneasy reality of global finance. For developing nations, debt has long been a double-edged sword. It promises growth but often erodes sovereignty. After World War II, institutions such as the IMF and the World Bank provided loans tied to strict reforms, which forced liberalization that deepened inequality. Into this landscape, China’s BRI offered an alternative, infrastructure financing framed as free from Western-style political conditions. Roads, ports, and power plants symbolized opportunity, but rising debt burdens reveal a growing cycle of dependency. The BRI thus raises a pressing question: is it a pathway to growth, or a new form of dependency with geopolitical costs?

Debt, Dependency, and Development: Theoretical Framework

The story of debt in the developing world has always been closely linked with questions of dependency. After World War II, institutions like the International Monetary Fund (IMF) and the World Bank became the main sources of credit for newly independent states in Asia, Africa, and Latin America. These loans were usually tied to structural adjustment programmes (SAPs), which required governments to adopt austerity policies, liberalize trade, and privatize state-owned industries. While the stated aim was to stabilize economies and promote growth, in practice, these conditions often reduced public spending on health, education, and welfare, thereby increasing inequality.

External capital, instead of being a pathway to sovereignty, became a tool of control. Against this background, China presented itself as a ‘different’ kind of lender. Through South-South cooperation rhetoric, Beijing promised loans without political conditions and emphasized mutual development. However, the question remains whether the Belt and Road Initiative (BRI) has truly escaped dependency dynamics. The increasing debt burdens of many BRI partner states suggest that even without IMF-style conditionalities, dependency can still be created through financial leverage and control over strategic assets.

China’s BRI is Infrastructure or Indebtedness?

China launched the Belt and Road Initiative (BRI) in 2013 as a global development strategy aimed at improving connectivity across Asia, Africa, and Latin America. It involves massive investments in infrastructure such as roads, ports, and power plants. The BRI is funded through different channels, including concessional loans with lower interest rates, commercial loans from Chinese banks, and collateralized lending tied to natural resources or future revenues. A distinctive feature is that projects are largely implemented by Chinese state-owned enterprises (SOEs), which means that much of the money flows back to China rather than circulating in the host economy.

Repayments are often linked to revenues generated by the projects, but when expected returns fail to materialize, countries struggle to meet obligations. This model contrasts with the IMF and World Bank, which impose strict policy conditionalities like austerity. China does not demand such reforms but often secures control over key assets when debts cannot be repaid. In practice, this means that while the West extracts compliance through policy, China exerts influence through infrastructure and ownership. The BRI, therefore, represents not just development financing but also a new form of dependency that raises important questions about sovereignty.

The Debt-Dependency Cycle through BRI in Practice:

The impact of the BRI can be best understood through examples where borrowing for development has led to dependency. In many countries, the loans taken for large infrastructure projects created repayment difficulties, which in turn deepened reliance on China. Across these cases, a clear pattern emerges. Countries borrow heavily from China with the expectation of development-led growth. When projects underperform, they are forced to take new loans, often from China itself, to meet old obligations. This creates a cycle where debt does not reduce dependency but reinforces it, turning infrastructure-led development into a long-term financial burden.

One of the most cited examples is Sri Lanka’s Hambantota Port. The government borrowed around $1.3 billion from Chinese banks to build the port, but the project did not generate enough revenue to service the debt. Unable to repay, Sri Lanka agreed in 2017 to lease the port and 15,000 acres of surrounding land to China Merchants Port Holdings for 99 years. This deal is often described as a ‘debt-for-equity swap’ and is seen as compromising the country’s sovereignty. It gave China a strategic foothold in the Indian Ocean, showing how loans could turn into geopolitical leverage.

Pakistan has also become deeply entangled in BRI financing. The China-Pakistan Economic Corridor, valued at around $62 billion, includes roads, power plants, and railways. While these projects improved connectivity, they also increased dependence on Chinese technology and imports. Repayment obligations added to Pakistan’s fiscal stress, pushing the country towards repeated IMF bailouts. This created a situation of ‘double dependency’, on China for infrastructure loans and on the IMF for debt servicing support. Pakistan’s economy has become locked into a cycle where new borrowing is required to repay older loans.

Unlike Sri Lanka and Pakistan, Bangladesh has enjoyed relatively stable growth, but its rising exposure to BRI loans raises concerns. The Padma Bridge Rail Link project, funded partly by Chinese loans, has suffered from cost overruns and delays. Bangladesh’s case shows that even countries with stronger economic indicators are not immune to the risks of overreliance on external borrowing. Several African states also illustrate the debt-dependency cycle. For example, Zambia defaulted on its external debt in 2020, much of which came from Chinese loans tied to copper-related infrastructure. Ethiopia and Kenya, other major BRI partners, have had to reschedule repayments to China, underlining Beijing’s leverage as a creditor.

Sovereignty, Strategy, and the Geopolitics of Debt:

Debt under the Belt and Road Initiative is not just an economic issue but also a strategic one. Chinese loans have often been tied to infrastructure projects like ports, railways, and mining concessions that give Beijing significant access to critical routes and resources. This pattern carries echoes of earlier Western lending practices that entrenched neo-colonial control, but China frames it differently under the banner of South-South solidarity. The rhetoric of ‘win-win cooperation’ often masks the unequal power between lender and borrower. For recipient states, dependency on Chinese financing can constrain sovereignty in visible ways. Sri Lanka’s foreign policy has tilted closer to Beijing, Pakistan has deepened its military and economic ties with China, and many African states consistently support China in UN votes.

Development or Dependency?

The debate over the Belt and Road Initiative is sharply divided. On the one hand, China defends the program by arguing that it fills a critical gap left by Western lenders. Many developing countries lacked access to large-scale infrastructure finance, and Beijing stepped in with capital that was otherwise unavailable. China also points to its willingness to restructure loans and claims that its financing comes without political strings, unlike IMF conditionalities. On the other hand, the BRI seems like a form of debt-trap diplomacy. China deliberately lends to weak economies, knowing they will struggle to repay, and then uses their vulnerability to secure strategic concessions. The reality, however, lies in between. For many states, the cost of dependency outweighs the immediate development gains, leaving them with infrastructure but reduced economic sovereignty.

Conclusion:

The BRI exposes a dilemma at the heart of global development finance: can nations pursue growth without surrendering sovereignty? For countries in Asia and Africa, China’s loans have built ports, highways, and power grids, yet the price has often been deeper dependency. The cycle of borrowing to service old debt reduces the space for independent policymaking and pushes governments into geopolitical alignments they might not otherwise choose. The real challenge lies not only in China’s strategy but in the inability of recipient states to negotiate on equal terms, strengthen governance, and build self-reliant alternatives. As the world rethinks development, one must ask, will debt continue to be the currency of power, or can finance be reclaimed as a tool of freedom?

Author’s Bio:

Vansh Vijay Aggarwal is a B.A. LL.B. student at Jindal Global Law School and a columnist at CNES.

Image Source: Fables of Chinese Debt Trap | South Asia Journal