By -Chandril Ray Chaudhuri

Abstract

India is a high reliance country on indirect taxes to raise revenue capacity and also to manipulate consumption. Theoretically, the impact of alterations in these taxes should be predictable on prices. This is hardly ever the case in practice. The increases in taxes are immediately reflected in the consumer prices whereas the decreases in taxes tend to pass by to the end consumers. This gap is not accidental. It is an indication of the way in which the markets, supply chains, and regulatory institutions operate in India.

This article will look at why the tax reductions will be consumed by producers and distributors and the increase of taxes transferred to consumers.It demonstrates the power of pricing, compliance cost, and low-quality enforcement in determining the tax outcomes using recent illustrations of GST rate changes, excise duties on fuels and tobacco, and reactions of the manufacturing and services industry. Indirect taxation is thus more visible to the consumer, particularly, the one with lower bargaining power.The article ends with policy recommendations in case of enhancing pass-through of taxes and restoring confidence in fiscal interventions.

Introduction : Why Tax Cuts in India Rarely Reach the Consumer, but Tax Hikes Immediately Do

The Indian state attempts to impact economic behaviour in one of the major ways, namely, fiscal policy. The indirect taxes like the Goods and Services tax, the excise taxes and the cesses are not only utilised to raise revenue but also to influence consumption patterns, correct the negative externalities and spur demand when an economy slows down. Theoretically, any alteration in the indirect taxes should have a predictable effect on final prices. A decrease in the taxation rate ought to cut the prices and increase the consumption, whereas an increase ought to suppress the demand and increase revenue. India, in effect, has a chronic asymmetry. Tax increases are nearly immediately transmitted to the consumer, and tax cuts are frequently spread through the supply chain and fail to be passed on as lower retail prices, a trend which has been repeated after the rationalisation of the GST rate and increases in excise duty.

One of the biggest influences that the Indian state tries to make to economic behaviour is fiscal policy. The indirect taxation, such as the Goods and Services tax, the excise taxes and the cesses, are not only used to raise revenue but also bring a shift in consumption, fix the adverse externalities and stimulate demand in a downward-trending economy. By definition, the final prices should have been predictably affected by any change in the indirect taxes. The reduction in the taxation rate should reduce the prices and demand for consumption, whereas an increase should soar the demand and generate more revenue. In effect, India is facing a chronic asymmetry. An increase in tax is almost immediately passed on to the consumer, meanwhile, a decrease in tax is often distributed through the supply chain and does not find its way into lower retail prices, a tendency that has been replicated following rationalisation of the GST rate and excise duty increments.

Conceptual Framework: Tax Pass-Through

Tax pass-through refers to the extent to which a change in statutory tax incidence affects market prices. Full pass-through occurs when prices change by the same magnitude as the tax. Partial pass-through occurs when prices change by less, with the remaining burden or benefit absorbed by producers or intermediaries. Asymmetric pass-through exists when price responses differ depending on whether the tax change is an increase or a decrease.

Empirical studies on the Indian Goods and Services Tax suggest that pass-through varies significantly across sectors and states, depending on market concentration, demand elasticity, and administrative factors. Research analysing post-GST price behaviour shows that firms adjust prices strategically rather than mechanically, particularly in sectors with pricing power or complex distribution networks. This provides the analytical foundation for understanding why tax hikes and tax cuts behave differently in practice.

Structural Reasons for Asymmetric Pass-Through : Pricing Power and Market Concentration

Market structure is one of the key factors affecting the passage of taxes. The producers have strong power in pricing in industries where there are few players but they are large players. Raising taxes, companies may explain the rise in prices by the policy of the government and transfer the burden with minimum opposition among customers. Consumers anticipate an increase in prices with an increase in taxes, particularly on basic or addictive products. This relationship is observable in the coverage of tobacco taxation cases, as manufacturers are obliged to hike prices as soon as taxes are increased.

Once the taxes are decreased, the same companies have minimal pressure when it comes to price reduction. They instead use the tax savings as a boost in margins. This has been seen many times in industries like tobacco, automobiles and packaged consumer goods where brand loyalty and lack of substitutions make the price less sensitive.

Inventory and Timing Effects

Tax reductions do not always change the cost system of the existing inventories. Retailers and wholesalers usually hold an inventory that was purchased at a higher tax rate. At current rates, companies usually offer such inventory in the market and subsequently reduce the price, if they reduce it. This delay can span a long period of several months as to the slow-moving stock, such as the case of durability goods basically offsetting the consumer advantage of the tax cut.

On the contrary, tax increment will be imposed immediately on fresh production or imports. When it comes to setting prices, firms adjust them as soon as the additional tax payment is to be afforded, and this means that quick passing through whenever a particular adjustment is made on excise taxes on cigarettes and other sin goods is undertaken.

Intermediary Capture in the Supply Chain

The supply chains of India are usually multi-layered, such that manufacturers, distributors, wholesalers, and retailers are involved. Margins can be adjusted in each layer. In case of tax cuts, the intermediaries often just take advantage of the situation by increasing margins, not lowering prices. This is more prevalent in markets where retail rivalry is restricted or where consumers do not have access to information on product prices (in opaque information).

News reporting on post-GST rate rationalisation exercises has reported more than once that price cuts reported at the statutory level do not necessarily feature in visible retail price cuts, particularly in the fast-moving consumer goods sector.

Compliance Costs and Working Capital Pressures

The Goods and Services Tax has increased formal compliance requirements for many firms. Input tax credit delays, frequent rule changes, and reporting obligations impose working capital costs, particularly on small and medium enterprises. Firms often use tax relief to offset these costs rather than passing the benefit to consumers. From the firm’s perspective, retaining tax savings helps stabilise cash flows in an uncertain regulatory environment, a concern frequently highlighted by industry bodies in response to GST changes.

Sectoral Case Studies

India’s taxation of tobacco provides a clear illustration of asymmetric pass-through. From February 2026, the central government implemented revised excise duties on cigarettes and other tobacco products, alongside a 40 percent GST slab for certain categories. According to Reuters, the new excise duty structure was expected to lead to immediate price increases by manufacturers to offset the higher tax burden. Official announcements and media reporting confirm that cigarette prices historically respond quickly to tax hikes due to inelastic demand.

Tax hikes are perceived as unavoidable external shocks. Firms face little reputational risk in raising prices following a government announcement of higher taxes. Consumers, conditioned by inflation expectations, accept price increases as legitimate. Tax cuts, on the other hand, lack enforceable mechanisms to ensure transmission. Governments may announce reductions, but unless accompanied by monitoring or price controls, firms retain discretion over pricing.

This asymmetry is reinforced by political and economic considerations, particularly around revenue and public health. Tax hikes are often framed as necessary for revenue mobilisation or public health, while tax cuts are framed as relief measures without clear accountability for outcomes.

Implications for Welfare and Fiscal Credibility

The efficacy of fiscal stimulus measures is compromised when tax cuts fail to reach consumers. It also contributes to public cynicism about tax policy, as consumers experience the costs of taxation more acutely than the benefits of relief. Over time, this erodes trust in fiscal institutions and weakens the legitimacy of indirect taxation as a policy tool, further creating distrust in governmental capability in regulating taxes.

Policy Recommendations

To improve tax pass-through, policymakers should adopt a combination of regulatory and market-based measures. Temporary pass-through requirements for specific tax cuts, enhanced price monitoring using GST data, and stronger competition enforcement can reduce intermediary capture. In cases where pass-through is unlikely, direct consumer transfers or targeted subsidies may be more effective than broad-based tax reductions.

Conclusion

The asymmetrical transmission of tax changes in India is not accidental but rooted in market structure, supply chain dynamics, and institutional design.Tax hikes reach consumers quickly because firms can justify price increases and face little resistance. Tax cuts fail to reach consumers because benefits are absorbed upstream and enforcement is weak. Recognising this asymmetry is essential for designing policies that efficiently and more importantly, effectively improve consumer welfare and maintain public trust.

About the author

Chandril Ray Chaudhuri is an undergraduate student of law at O.P. Jindal Global University with a strong interest in critical theory, media studies, and economic politics, global and domestic. His work often deals with understanding class and resistance. He researches the morality and politics of law and its intersection with economics.

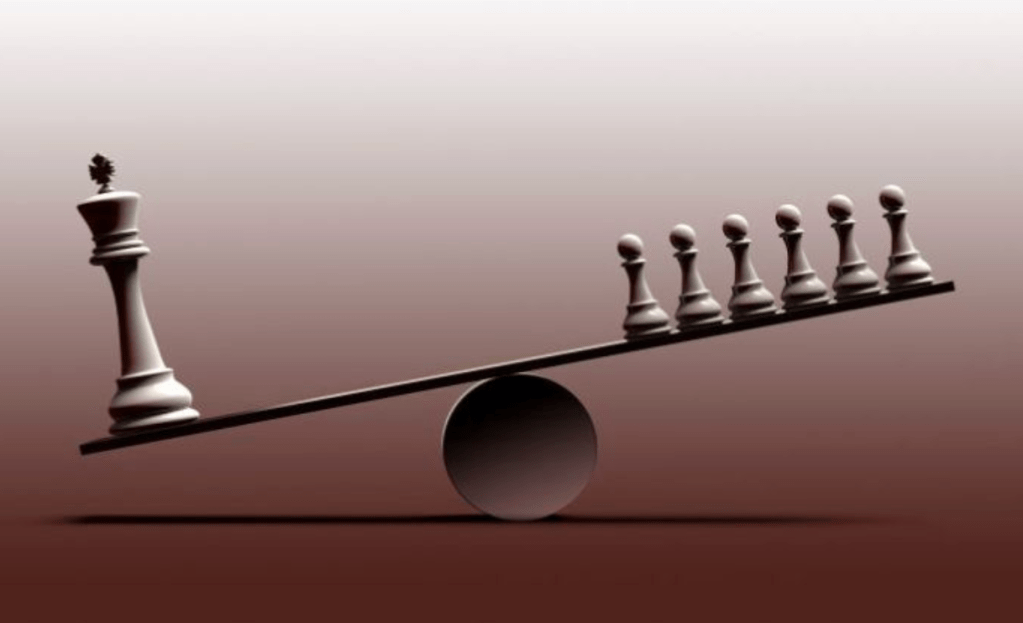

Image Source: https://www.freepik.com/premium-photo/close-up-chess-pieces-seesaw-against-colored-background_126348623.htm