By Aryan GK

Abstract

The 77th round of borrowing trends among Indian households reveals a significant shift towards institutional lending, with bank-linked self-help groups and non-banking financial companies experiencing a notable rise. Medium-term loans have become more prevalent, indicating a changing borrowing pattern. Additionally, there is a transition from simple to compound interest, particularly noticeable in institutional agencies. Non-institutional sources, despite a shift in interest structures, continue to play a substantial role in meeting borrowing needs. This analysis underscores the evolving landscape of Indian household borrowing, characterized by increased institutional reliance, longer loan durations, and a diverse interest landscape.

Introduction

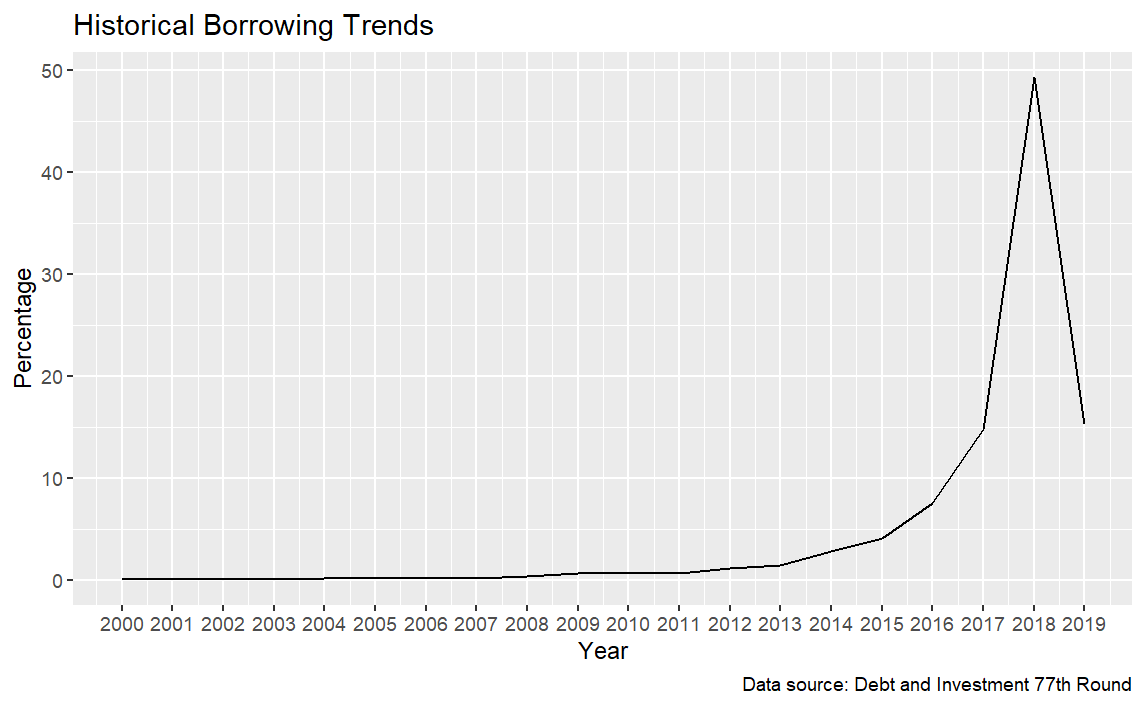

The graph above illustrates a steady rise in borrowing among Indian households based on the data extracted from the NSSO 77th round of Debt and Investment report. Indian households have experienced a 49 percent surge in borrowings from 2000 to 2001. A 49 percent surge in borrowings by Indian households since 2000 indicates that they are increasingly assuming additional debt or loans. The rise in borrowing can be influenced by multiple variables, including economic expansion, fluctuations in interest rates, shifts in consumer purchasing patterns, and the financial incentives provided by banks and financial institutions. An escalation in borrowing can provide both advantageous and detrimental consequences. Positively, it signifies enhanced loan accessibility for households, enabling them to invest in education, housing, or entrepreneurship. Excessive borrowing without adequate financial planning might result in debt-related stress and financial instability for certain households.

To gain a deeper understanding of the ways in which households obtain loans, we will examine the credit institutions that offer lending services. There are primarily two categories of lending agencies: institutional and non-institutional lending agencies.

- Institutional lending agencies: Institutional lending agencies refer to organizations or companies that offer loans and credit services to individuals, corporations, or other institutions. These entities encompass banks, credit unions, financial institutions, and government agencies that provide financial products and services, such as loans, mortgages, and credit lines.

- Non-Institutional lending agencies: Non-institutional lending agencies, also known as informal or alternative lending sources, refer to organizations or entities that provide loans and credit services outside of traditional financial institutions like banks and credit unions. These sources may include peer-to-peer lending platforms, online crowdfunding platforms, moneylenders, individual investors, or community-based lending groups.

In the 77th round of Debt and Investment NSSO Survey, there is a noticeable rise in the quantity of loans offered by institutional agencies, with bank-linked self-help groups (SHGs) accounting for 12 percent, followed by non-banking financial companies (NBFCs) at 7.8 percent. However, the majority of loans are still obtained via non-institutional entities, with market commission agents holding the largest portion of the total loans supplied.

| Credit Agency | Number of Loans Provided | Percentage |

| Bank-linked SHG | 10467 | 12.54 |

| Market Commission Agent | 63494 | 76.09 |

| NBFC | 6526 | 7.82 |

| Non Bank-linked SHG | 1575 | 1.88 |

| Other Institutional Agencies | 1378 | 1.65 |

77th NSSO Survey Debt & Investment

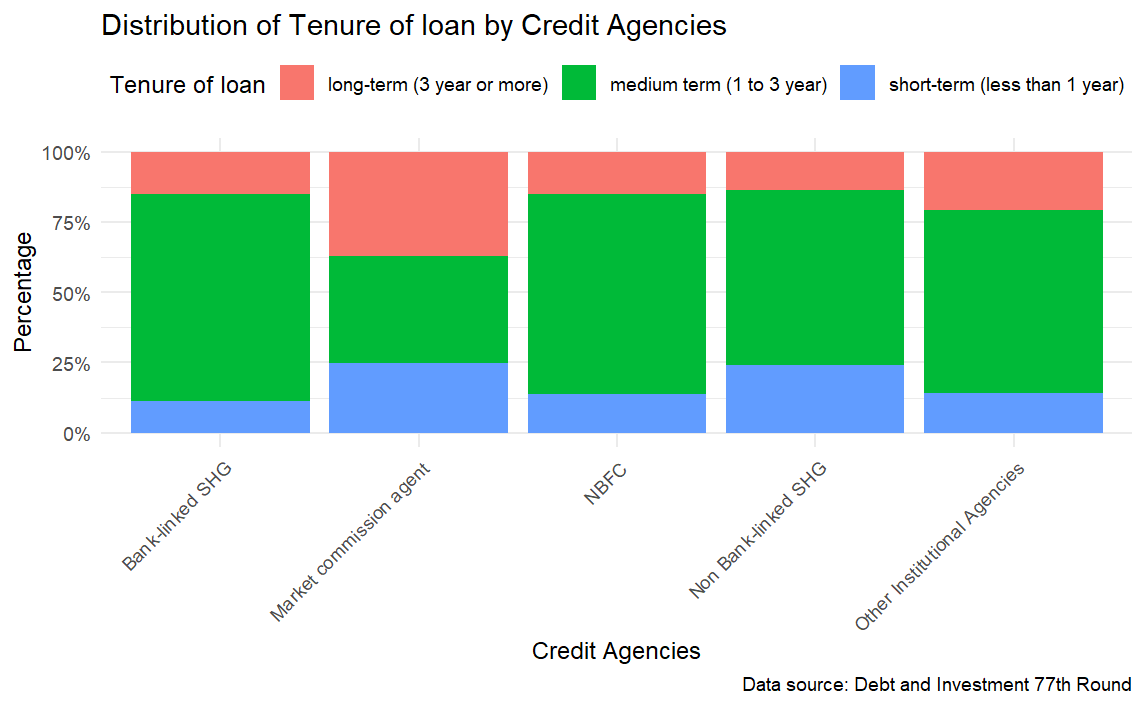

Loan period of borrowings by Indian households

During the 77th round, it is evident that Indian households predominantly obtained loans for a duration of one to three years, which may be classified as a medium-term borrowing. There has been a significant shift in borrowing patterns, since the bulk of loans in the 70th round were taken for a short duration. During this period, we observe an increase in households seeking loans from institutional agencies to fulfill their medium-term borrowing needs. This trend suggests an enhanced availability of loans from such agencies.

Nature of interest on the loans acquired

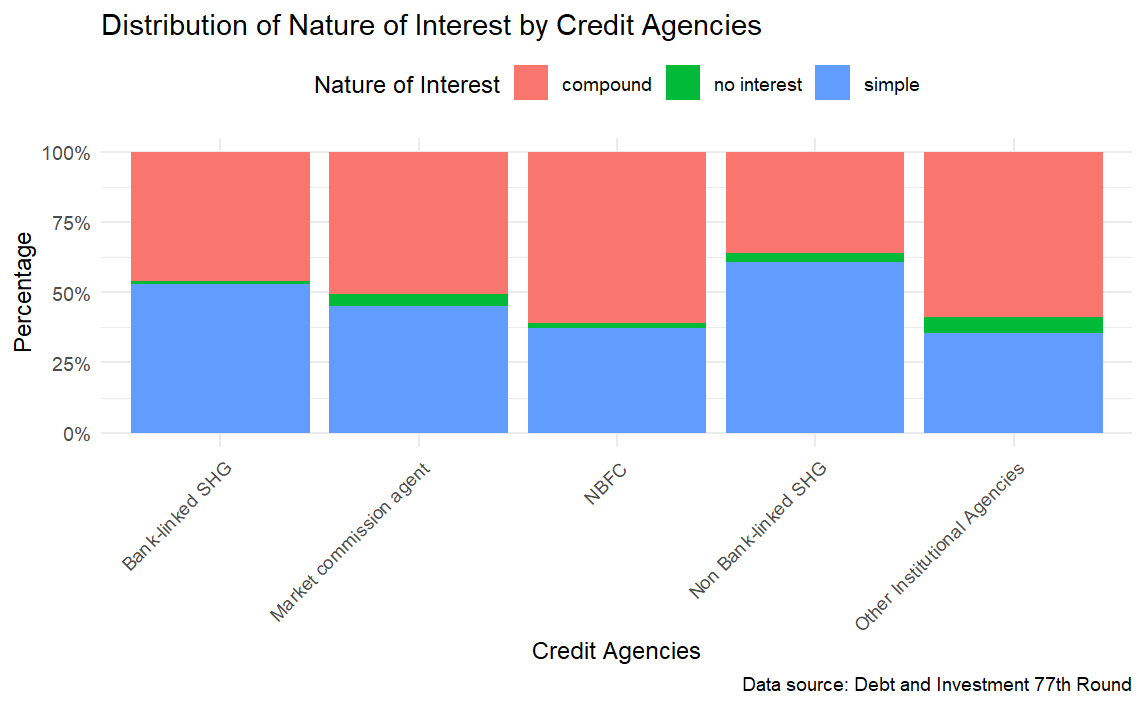

In order to have a deeper understanding of the borrowing patterns of Indian households, it is necessary to examine the interest payments associated with the borrowed amount.

In the 77th round by the process of NSSO data extraction, Indian households are observed obtaining loans at a compound interest rate, which stands in stark contrast to the 70th round where loans were acquired with simple interest. Furthermore, it is evident that institutional organizations have offered loans with both compounded and basic interest rates. In this round, it is seen that non-institutional agencies have predominantly offered loans at compound interest rates, which is a shift from the 70th round where non-institutional agencies were giving loans at simple interest.

Conclusion

An analysis of the 77th rounds, along with institutional and non-institutional loan institutions, offers valuable insights into the evolving borrowing trends among Indian families.

Borrowing Trends: During the 77th round, there was a significant rise in loans from institutional agencies, including bank-linked self-help groups (SHGs) and non-banking financial firms (NBFCs). There is a noticeable trend towards institutional lending, although non-institutional organizations continue to have a substantial impact.

Loan Duration: The 77th round indicated a transition towards medium-term loans, indicating that Indian households are increasingly seeking loans for a longer period of time. Institutional agencies are increasingly important for meeting medium-term borrowing requirements.

Interest Type: In the 77th cycle, there was an increase in the popularity of compound interest loans, and institutional agencies began providing both compound and simple interest loans. Non-institutional agencies transitioned from offering loans with a simple interest structure during the 70th round to loans with a compound interest structure during the 77th round.

Loan Distribution: Examining lending agencies reveals two main categories: institutional and non-institutional. Institutional agencies include banks, credit unions, and government entities, while non-institutional sources encompass peer-to-peer lending platforms and community-based groups. In the 77th round, institutional agencies, particularly bank-linked self-help groups and non-banking financial companies, saw a rise in loan offerings. However, the majority of loans still come from non-institutional entities, with market commission agents holding the largest share.

Interest Structures: Institutional entities, provided loans with diverse interest structures, encompassing compound and simple interest. In the 77th round, they transitioned to offering loans with a compound interest structure.

Collectively, these comparisons emphasize a shifting scenario in the borrowing patterns of Indian households. The use of institutional agencies, particularly for loans with medium-term durations, is increasing. Additionally, there is a transition in the type of interest being charged, moving from simple interest to compound interest. Nevertheless, non-institutional agencies persist in catering to a substantial share of borrowing needs, highlighting the existence of a varied range of loan sources and preferences among Indian households.

Author’s Bio

Aryan Govindakrishnan is a second-year student at the Jindal School of Government School and Public Policy, pursuing Masters in Economics. His research interests include finance policy and economics.

Image Source: https://www.indiatoday.in/who-is-what-is/story/900-million-indians-live-in-2-rooms-or-less-327534-2016-07-05