By Shreya Tiwari

Abstract

This essay examines the ongoing problem of money laundering and how it affects financial institutions around the world. It highlights the urgent need to stop this illegal practice with astonishing estimates of the amount of money that is laundered each year. As organisations use these havens for money laundering, the spread of offshore banks and international tax havens worsens the issue. It has become harder and harder for governments to monitor and trace money transactions in these regions because of the resulting opacity and competition among economies to draw in foreign investors.

Money Laundering- Dwelling into Financial Crimes

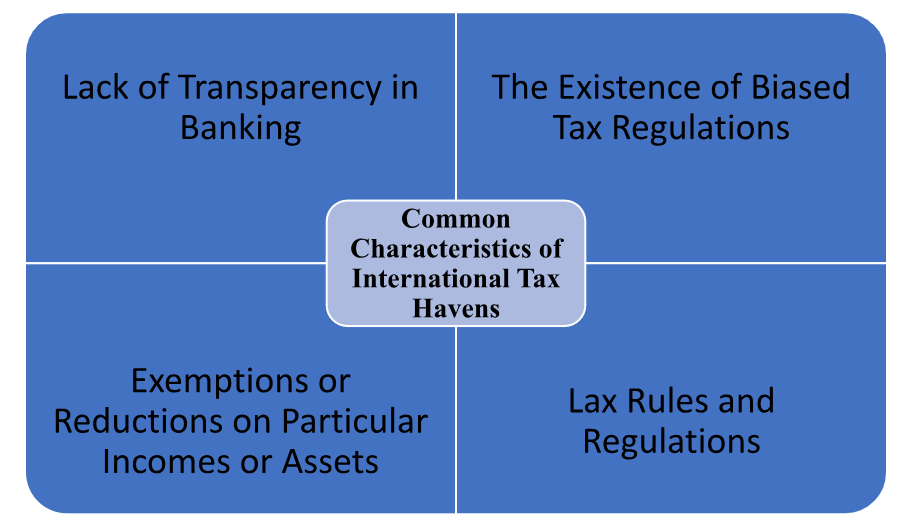

The problem of money laundering has existed for a long time now and influences financial institutions globally. Furthermore, experts have determined and estimated that since large amounts of money are laundered globally every year, it has become the need of the hour to combat this criminal activity. Furthermore, the existence of international tax havens and offshore banks has added to this problem. Money laundering follows a three-stage cycle: Placement (introducing illegal funds into the system), Layering (complex transactions to conceal origins), and Integration (reintroducing cleaned funds as legitimate assets). This process helps criminals hide their illicit gains within the legal economy. Many businesses are solely created in order to become tax havens and the usage of offshore accounts and banking is done for laundering money. These accounts are usually set up in geographical regions wherein individuals or businesses are given a variety of benefits, the prime one being a lower tax rate. Economies compete with one another to provide tax breaks and other inducements to overseas investors. In certain locations, financial information is kept confidential. It has now become difficult for governments from other countries to monitor the flow of money and determine who owns what assets in certain regions.

People and businesses that want to pay less tax, hide their money from creditors, and this money whether “black” or “white” is deposited into offshore accounts or tax havens for this reason. The usage of offshore banking services and tax havens also provides those who use them with the benefit of being able to hide the source of funds and the ownership details. However, it is pertinent to consider that all countries having low tax rates do not automatically become tax havens. For a country to become a tax haven it needs to offer this benefit to outsiders to ultimately attract investment from foreigners. Additionally, there exist countries that are globally recognized as tax havens. These countries are namely, the Cayman Islands, Switzerland, Monaco, etc.

Tax Havens and Offshore Banking- Shades of Secrecy

The laundering of money is carried out in various ways, the most common one being the creation of shell companies. A shell company commonly known as a “paper corporation”, is one that exists without any actual operations. Its primary purpose is to launder large amounts of money, or assets without revealing any details that can aid in tracing the transaction or the owner. These companies are usually created in areas that lack transparency in their banking areas and have very relaxed regulations on tax. This benefits those individuals who commit this crime as they can launder or move any amount of money without drawing too much attention to themselves. Additionally, in doing this these individuals can keep laundering their money, by making expensive and luxury purchases such as boats, real estate, etc. as assets of the company.

People carry out offshore banking in a country that is not their residence nor the originating place for the funds to ensue anonymity and make retracing extremely difficult. Tax havens offer very low tax rates and the ability to park their funds in an offshore place to wherein their resident jurisdiction cannot extend to. This also helps foreigners in managing their assets and operate in foreign countries. Offshore banking and international tax havens play a critical role in assisting money laundering allowing for transactions to occur from anonymous bank accounts. Multiple foreign banks allow one to open an account without proper ID, and using these accounts to move money, leaves no record or trace. This also means that frequently the money sent through these anonymous channels is unnoticed by the authorities. Such evasion of taxes and authorities is often legal and can be carried out by transfer pricing or shell corporations set up overseas. Tax havens have also successfully ensured safeguarding the privacy and protection of individuals carrying out such actions, this is because there are laws in place at such offshore banks and tax havens, which protect the individual from extradition or from revealing the identity of the account holder. In totality, this process of regulated financial crime makes it extremely difficult for regulators and government officials to obtain financial information. Thus, the money is safe from creditors and political unrest, which makes these countries attractive places for individuals to use offshore banking. While it is beneficial to an individual it may stray from legal to illegal very soon, with fraud, money laundering and tax evasion being common activities taken up by offshore bankers.

Many people convert their black or illegally obtained money to white money and then send it across to tax havens in a legal form, this ensures money is cleansed while leading to very little suspicion of the individual. Moreover, to reduce suspicion many people use tricks such as using fronts or companies such that their identity is not revealed. This concealed nature of the transactions makes it very hard for the banks and the authorities to apprehend and punish the people undertaking such actions. The increased need for transparency is faced on a global level, with collaborations between global financial organizations and law enforcement agencies. Furthermore, the establishment of the Financial Action Task Force or FATF lays down global rules for combating money laundering. One such recommendation put forth by the authority is the increased collaboration between financial institutions and law enforcement.

The Crime Ball Starts Rolling- Case Study

The Panama Papers Scandal was a case of money laundering which occurred using tax havens and offshore banks on an enormous scale and depth. The Panama-based law firm Mossack Fonseca was using a network of over 214,000 tax havens which were being used to hide the assets of people from 200 different nations. The working of tax havens in this scandal closely resonates with the network theory wherein several individuals or groups work in close contact and sync for the seamless commission of money laundering. While most of the transactions which were revealed as part of the exposed articles were legitimate and legal, Mossack and Fonesca had also set up multiple shell corporations solely for the purpose of hiding the taxes and money of their clients. These shell corporations were extensively being used for fraud and evading taxes which they would have to pay for if they made the assets owned by these shell corporations public. Moreover, it became an international scandal due to the multitude of nationalities using the services of the law firm, and the evasion of international sanctions which were being imposed on their clients who were big corporates, politicians, world leaders, and celebrities. The use of these services from the law firm was illegal, and the German government had also put out an arrest warrant for the founding partners of the law firm, pressing charges of running a criminal organization on them. But like many tax havens, Panama has a very opaque legal system, with little to no extradition facilities, therefore, the lawyers continue to operate their law firm. Moreover, the long web of transactions allows for no one’s identity to be clearly revealed, only one case has been filed for money laundering against Herald Joachim, a USA citizen, who was convicted of wire and tax fraud, money laundering.

Conclusion

In conclusion, money laundering via the means of international tax havens and offshore banking is becoming increasingly popular, more so with the use of technology as the web of transactions can occur from a single place making it very difficult for authorities to then link the transaction back to the actual culprit. Now that technology is being integrated into systems by the regulatory authorities for helping and assisting them in detecting such fraud and laundering activities that lead to tax evasion.

Author’s Bio

Shreya Tiwari is a fourth-year BA-LLB student at Jindal Global Law School with a keen interest in exploring the intricate connections between law, finance, and economics and their profound impact on the global economy. When not engaged in academic pursuits, she enjoys expressing her creativity through painting and sketching. Her curiosity also extends to the captivating realms of corporate law and the intriguing world of white-collar crime studies.

Image Source: https://thedocs.worldbank.org/en/doc/605901583339487690-0050022020/original/EliteCaptureofForeignAid.pdf