By Chetan Soni

Abstract

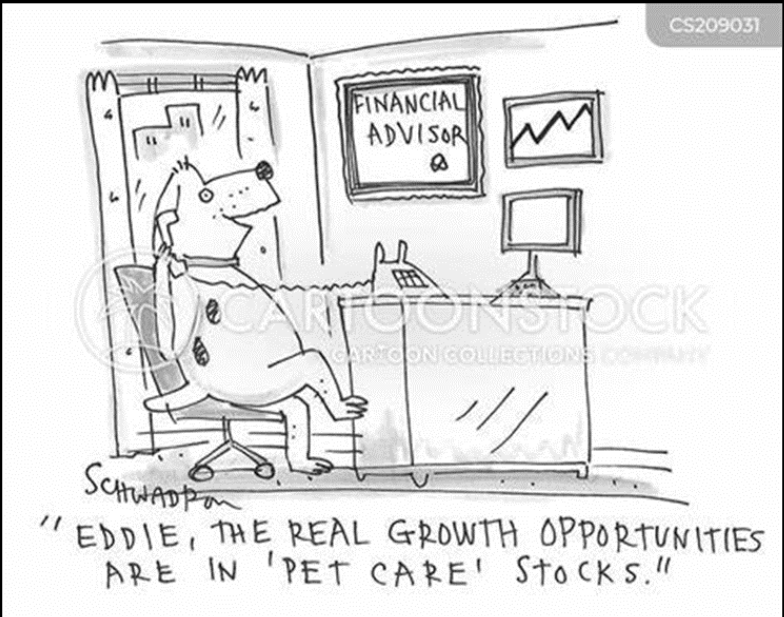

This article examines the dual function of short-selling research firms, using Hindenburg Research as an example, in the intricate world of financial markets. These organisations have become well-known for their bold inquiries into suspected business and financial irregularities while concurrently maintaining short positions in the stocks of the companies in question. The inherent conflict of interest created by this dual function is the topic of this article.

Short-selling research organisations have emerged as both watchdogs and provocateurs in the complicated and frequently acrimonious world of financial markets. Hindenburg Research is one such organisation that has recently been in the limelight for its contentious work in the field. A research-based firm in this sector focuses on investigating alleged financial and corporate irregularities while concurrently holding short-bets in the stocks of the corporations it investigates. As apparent, the deep conflict of interest that results from this dual job serves as the main focus of this article, along with controversies that Hindenburg Research and other similar firms have to deal with.

Nathan Anderson established Hindenburg Research in 2017, and soon after, it rose to prominence for its audacious approach to investigations. The company, having a name inspired by the infamous Hindenburg accident, is framed to be synonymous with catastrophic crashes, and was created with the intention to uncover and make public any alleged wrongdoings within corporations. Its investigations are meticulously detailed, culminating in comprehensive reports that allege a wide range of corporate malfeasance. Its role is to conduct in-depth investigations that result in extensive findings so as to make numerous allegations of corporate wrongdoing. However, unlike an investigative journalist, these financial detectives do in fact have a direct stake in the material they share with the public. They only publish and share research of the companies in which they hold a short position.

What this means is that they effectively build a short position by borrowing shares of this target company from a brokerage firm, and then selling them, as they expect the stock price to fall based on the publishing of their negative research. When the price of the stock falls, the short seller i.e, the activist short-seller here will now buy cheaper shares back, and return them to the broker while pocketing the difference. Hence, the more catastrophic the research, the greater the profit the research firm will pocket. Furthermore, it is crucial to note that many times it is the not-so-aware retail investor who ends up suffering from this drop in value.

This activity of preying on another’s downfall inevitably leads to hatred from the executives and the general public. Short-selling in itself has thus been banned in some countries. The Gamestop fiasco can be said to have been a showcase of the public’s unhappiness towards such activities. However, at the same time, it can be argued that it is in fact fair value for pre-empting corporate frauds. James S Chanos, the founder of the short-selling hedge fund Kynikos Associates, having made money by predicting the accounting fraud by Enron in 2001, was one who lost money during the ‘short shorts’ of Gamestop shares.

The simmering argument continues beneath the surface, as companies argue that by conducting such short-selling research, they protect the integrity of the market, and prevent investors from being duped. Their presence inadvertently has a deterrent impact on the corporates from committing large-scale corporate fraud. While their underlying motives and profiteering have produced important moral and perhaps legal issues, it does not take away from the fact that they do end up acting as watchdogs for the economy. Moreover, it can be argued that short-sellers merely point out and reveal inflated share prices not based on real growth parameters but rather fuelled by fraudulent practices and oftentimes piggybacking a bull economy.

A valid critique to the same however is the power that is accorded to such short-sellers. The targets of such short-sellers could in fact be cherry-picked, and selected on the basis of their potential for substantial financial gain rather than the gravity of the alleged misconduct. Even more concerning could be the selection of such firms motivated and picked by the investors, and financial backers of these short-selling firms. Such allegations end up questioning the credibility and objectivity of the research, fuelling scepticism among market participants.

As we delve deeper into this discourse, it becomes evident that the conflicts Hindenburg Research and its peers face extend beyond ethical dilemmas. The very same thing occurred after the impact of Hindenburg’s research on the Adani group. Advocate ML Sharma filed a petition for “duping the Indian share market and innocent investors for their vested interest to provide complete justice”. The allegations of market manipulation via indirect holdings in Mauritius, along with breaches of securities laws have led to the Apex Court ordering the financial markets regulator, the Securities and Exchange Board of India (SEBI), to initiate an investigation into the entity.

However, a crucial point to note here is that the short-positions held by Hindenburg are not against the investors in the Indian stock market i.e., no direct benefit occurs to the research entity via the loss that occurred due to the report in the Indian market. The disclosure reveals that it does have a vested interest in Adani’s downfall, however the same is due to its position against the debt raised by the Adani group in the US financial bond market. Further speculations on targeting and disrupting the Indian financial market even while not holding a direct stake led to the questioning of a big investor in the firm– George Soros, who has been a vocal opponent of the present Indian government at the helm. But, even while the question of their motives is raised, the reader must remember to read the report and question whether it is in fact baseless, especially when the company in its public response has not been able to satisfactorily answer the allegations.

In conclusion, it is pertinent to note that the role played by such short-sellers is crucial to the stability of financial markets, and in helping the government regulator by specifically pointing toward where to look at. The age of skyrocketing valuations, at times fuelled by impossible growth, as is being seen in the case of Byjus, points to a further need for such firms which prevent corporates in the lookout for quick capital to continue adhering to the disclosure requirements. However, the potential for cherry-picking by such firms must also be prevented via the regulator, and detailed rules for their functioning, along with disclosure requirements of their investors must necessarily be followed to prevent the same. In addition to the above, any false or doctored information published by such a short-seller firm must necessarily be met with large penalties. Striking this balance between protecting investors, ensuring market integrity, and allowing for legitimate investigative work will be an ongoing challenge. In this dynamic environment, transparency and accountability will remain crucial in navigating the complex conflicts faced by firms like Hindenburg Research and shaping the future of financial markets.

Author’s Bio

Chetan Soni is a 5th-year BA-LLB Student from Jindal Global Law School. He is interested in the intersection between law and economics, and how intrinsically this interaction impacts the daily lives of the common man. In his free time you can catch him discussing the implications of the country’s macroeconomic policies, or weirdly engrossed in a debate of whether the current South African Cricket team is best placed to shine on the competitive international stage in years!

Image Source: https://www.cartoonstock.com/directory/c/conflicts_of_interest.asp