-

The Uneven Burden of Indirect Taxation in India:Why Tax Hikes Reach Consumers Faster Than Tax Cuts

Read more: The Uneven Burden of Indirect Taxation in India:Why Tax Hikes Reach Consumers Faster Than Tax CutsBy -Chandril Ray Chaudhuri Abstract India is a high reliance country on indirect taxes to raise revenue capacity and also to manipulate consumption. Theoretically, the impact of alterations in these taxes should be predictable on prices. This is hardly ever the case in practice. The increases in taxes are immediately reflected in the consumer prices…

-

The Health Security Tax Paradox: Fiscal Centralisation and the Black-Market Boom

Read more: The Health Security Tax Paradox: Fiscal Centralisation and the Black-Market BoomBy – Inika Gupta Abstract The January 2026 fiscal policy, introducing a permanent Health Security-cum-National Security Cess and 40% GST on tobacco, centralises revenue, eroding state fiscal autonomy. This aggressive taxation creates massive price arbitrage, inadvertently subsidising the illicit black market. Consequently, compliant manufacturers must pivot from tax management to aggressive Intellectual Property litigation to…

-

Taxing Market Optimism: Capital Gains Reform, Policy Predictability, and the Indian Retail Investor

Read more: Taxing Market Optimism: Capital Gains Reform, Policy Predictability, and the Indian Retail InvestorBy – Karishma Jain Abstract Recent fiscal discourse in India has increasingly focused on capital gains taxation through the lenses of parity, simplification, and revenue certainty. This shift has coincided with a steady rise in retail participation in financial markets, placing household investors at the centre of tax policy outcomes. This article examines recent capital…

-

Price vs Policy: Why Recent GST Cuts Have Not Fully Lowered Consumer Prices in India

Read more: Price vs Policy: Why Recent GST Cuts Have Not Fully Lowered Consumer Prices in IndiaBy – Dhruvi Solanki Abstract India’s recent Goods and Services Tax (GST) rationalisation was expected to provide relief to consumers by lowering prices and easing inflation. However, despite reductions in GST rates across several categories, retail prices have largely remained unchanged. This article examines why GST cuts have not translated into visible price reductions. It…

-

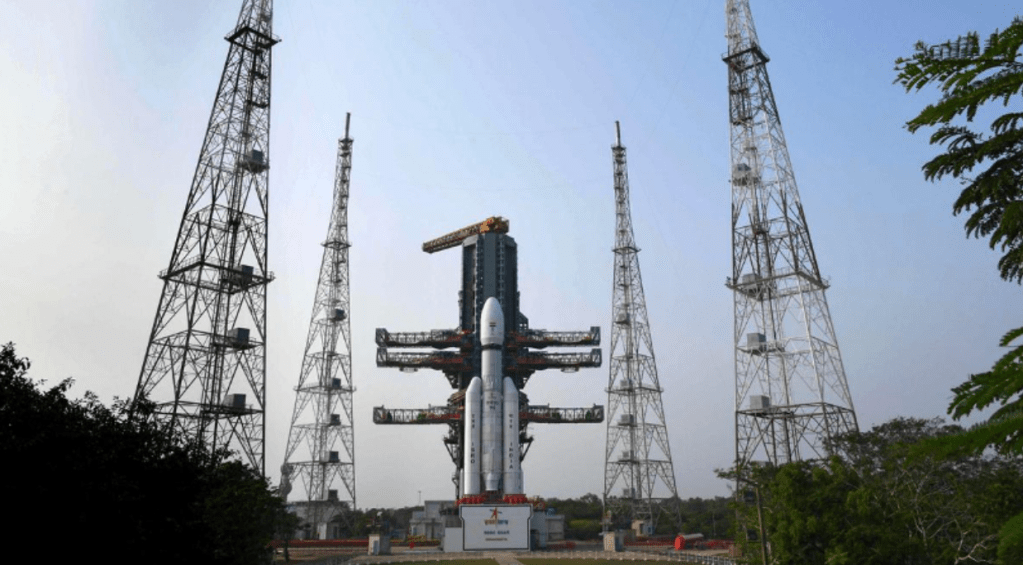

How Open Can Strategic Sectors Be? Foreign Investment, Sovereignty, and India’s Space and Nuclear Policies

Read more: How Open Can Strategic Sectors Be? Foreign Investment, Sovereignty, and India’s Space and Nuclear PoliciesBy – Karishma Jain Abstract India’s investment policy has shifted in response to disruptions in global supply chains, intensified competition in critical technologies, and a growing recognition that foreign capital can carry strategic implications beyond economic value. While attracting foreign investment remains central to India’s development strategy, the State has become increasingly attentive to questions…

-

When the Rupee slips but the Economy runs

Read more: When the Rupee slips but the Economy runsBy — Aashrith Rajesh Abstract The Indian Rupee’s fall to record lows against the USD in 2025 has coincided with strong economic growth, giving rise to questions as to what is actually happening. This article argues that such coexistence is common in emerging markets where real outputs and incomes continue to rise despite nominal currency…

-

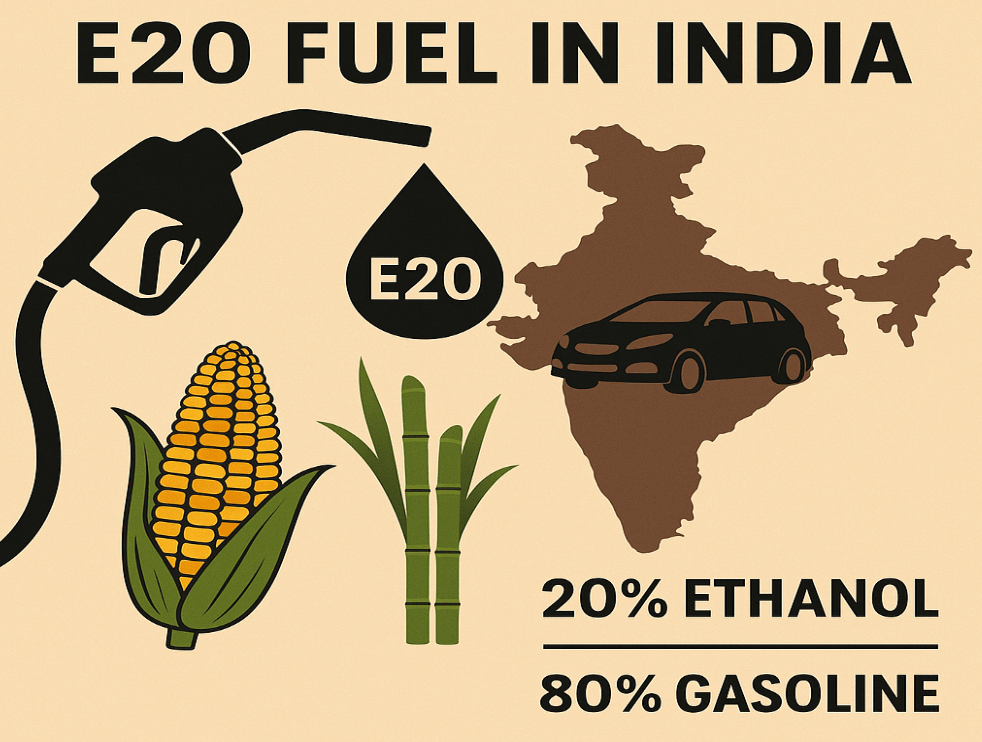

E20 FUEL IN INDIA- A GREEN ROADBLOCK

Read more: E20 FUEL IN INDIA- A GREEN ROADBLOCKBy – Aashrith Rajesh Abstract India’s shift to the E20 blend aims to cut pollution and reduce crude oil imports but faces major economic and practical challenges. Ethanol while being renewable, corrodes fuel systems since the older vehicles are not equipped for this higher ethanol content. On the supply side, diversion of sugarcane for the…

-

When Pork becomes Geopolitics: Chinese Tariffs and the Chances for Retaliation on Trade

Read more: When Pork becomes Geopolitics: Chinese Tariffs and the Chances for Retaliation on TradeBy Geetaali Malhotra Abstract: China’s tariffs on EU pork mark a new phase in trade wars, extending retaliation from industrial goods to food staples. By targeting Europe’s largest exporters, Beijing ties disputes over electric vehicles to a commodity central to its own diet, signalling the politicization of food security. This “porkification” of trade wars echoes…

-

War as a Business Model: Global Investment in Gaza’s Erasure

Read more: War as a Business Model: Global Investment in Gaza’s ErasureBy — Bhavya Shivhare Abstract: In the age of algorithmic warfare, corporations have become embedded in the machinery of conflict, not as observers, but as financiers and enablers. This article traces how dual-use technologies, research subsidies, and private capital sustain the AI-driven assault on Gaza, revealing a war economy where destruction generates dividends and the…

-

The Economics of War and Peace

Read more: The Economics of War and PeaceBy – Siddharth Gokhale Abstract The Economics of War & Peace presents a compelling and deeply critical re-evaluation of conventional economic policy in post-war and fragile states. Its core thesis is straightforward yet profound: economic policies and analysis, often seen as neutral tools for development, are in fact powerful instruments that can either lay the…

-

The Cost of Peace

Read more: The Cost of PeaceBy – Geetaali Malhotra Abstract The Cost of Peace: What War Leaves Behind is a reckoning with the brutal arithmetic of postwar life. When the guns fall silent, the battlefield shifts to balance sheets where deficits deepen, welfare shrinks, and the poor pay the highest price for conflicts they did not choose. From Ukraine’s trillion-dollar…

-

Opportunity Costs in War-Torn States: Defence Spending vs. Social Welfare

Read more: Opportunity Costs in War-Torn States: Defence Spending vs. Social WelfareA critical examination of the allocation of resources in conflict areas By – Soha Khan Abstract It is truism that the money spent on defense systems cannot be used for other needs. In conflict-ridden States, one of the biggest concerns is deciding the opportunity cost of choosing defense spending over social welfare. These are perennial…

Penny for your thoughts?

We are accepting articles on our new email: cnes.ju@gmail.com